Kaiser Permanente Member Connect Self-Service

KP Member Connect is a B2B platform designed to help businesses manage employee insurance coverage and facilitate payments for health benefits. As an integral part of Kaiser Permanente’s employer services, the platform provides companies with an efficient and compliant way to oversee healthcare plans, ensuring that employees receive the coverage they need.

Through KP Member Connect, employers can:

Enroll and manage employee insurance coverage for Kaiser Permanente health plans.

View plan details, coverage status, and billing summaries in a centralized system.

Make premium payments and manage billing cycles through an integrated payment system.

Access compliance reports and coverage documentation, ensuring seamless HR and benefits administration.

This enterprise-grade platform serves as a critical tool for businesses to simplify insurance management, reduce administrative workload, and ensure timely payments.

My Role

As a Senior UX Designer, I was responsible for improving the usability, efficiency, and overall experience of KP Member Connect, ensuring that businesses could seamlessly manage employee insurance coverage and payments. My role required close collaboration with product managers, developers, and business stakeholders to align on enterprise needs, compliance requirements, and technical feasibility while designing a scalable and user-friendly solution.

Key Contributions & Responsibilities

Improving the Coverage Management Experience

Designed an intuitive dashboard that allowed businesses to view and manage employee benefits at a glance.

Simplified the enrollment and coverage adjustment workflows, making it easier for HR professionals to add, remove, or modify employee plans.

Ensured compliance with healthcare regulations and employer benefit requirements, integrating necessary safeguards into the UX.

Enhancing B2B Payment Processes

Streamlined the billing and payment experience, ensuring that businesses could easily access invoices, track payment statuses, and complete transactions efficiently.

Designed automated payment options and billing reminders to reduce missed payments and administrative overhead.

Worked with the finance and legal teams to ensure the UX aligned with payment processing standards and security protocols.

Collaboration & Design System Integration

Partnered with Kaiser Permanente’s design system team to ensure that KP Member Connect followed consistent UI patterns, accessibility guidelines, and branding standards.

Conducted stakeholder reviews and usability testing, ensuring that HR professionals and business users could navigate the platform effortlessly.

Iterated on designs based on feedback from employers, internal teams, and real-world usage data.

Through my efforts, KP Member Connect became more intuitive, scalable, and efficient, improving how businesses managed healthcare coverage and payments for their employees.

Project Process

The design process for KP Member Connect closely mirrored the structured workflow used for the pharmacy experience, but with key differences due to the use of the legacy design system and distinct ADA compliance requirements for its business-oriented user group. Given that KP Member Connect served HR professionals, benefits administrators, and finance teams, the design had to prioritize efficiency, clarity, and compliance with enterprise accessibility standards.

🔍 Step 1: Kickoff & Scope Alignment with the Product Team

To ensure that our designs addressed business needs, compliance regulations, and technical feasibility, we began with:

Stakeholder discussions to understand pain points in coverage management and payment workflows.

Alignment with the product and development teams on what was technically feasible within the legacy design system.

Review of regulatory and legal constraints, ensuring that the platform met B2B healthcare compliance requirements.

🎨 Step 2: UX & UI Design Execution within the Legacy Design System

Unlike the pharmacy section, which followed an updated design system, KP Member Connect operated under legacy UI patterns. This meant:

Designing within pre-existing UI constraints while improving usability through layout optimizations and streamlined workflows.

Ensuring consistency with older components while proposing modern UI improvements where possible.

Creating scalable, structured dashboards and forms to accommodate large amounts of employee data without overwhelming users.

🛠️ Step 3: ADA Compliance Adjustments for Business Users

Unlike patient-facing platforms, KP Member Connect had a different set of ADA requirements due to its B2B user group. This required:

Adapting keyboard navigation and screen reader accessibility for users handling complex data entry tasks.

Implementing contrast adjustments and focus indicators to support HR professionals working with dense tables and reports.

Ensuring that form fields and interactions were optimized for accuracy, reducing errors in benefit management and payment processing.

📋 Step 4: Review & Iteration with Key Teams

Before development, our designs underwent multiple review phases to ensure compliance and usability:

Legacy Design System Team Review – Ensured our updates fit within existing UI constraints.

ADA Compliance Review – Verified that accessibility adjustments met the specific needs of business users.

Stakeholder Feedback – HR professionals and finance teams tested prototype interactions, data views, and task flows.

🚀 Step 5: Development Handoff & Design QA

Once designs were approved, we worked closely with development teams to ensure smooth implementation:

Provided detailed specifications for modifying the legacy UI while maintaining functional improvements.

Conducted design QA to verify that data-heavy dashboards, forms, and billing interfaces worked as intended.

Iterated based on post-launch feedback, refining usability and adjusting for additional accessibility concerns.

Key Features

As part of my work on KP Member Connect, I focused on improving key workflows that directly impacted businesses managing employee insurance coverage and payments. These updates enhanced usability, streamlined administrative processes, and ensured compliance with enterprise-level accessibility and security standards.

Account Summary – Improving Information Clarity

Account Summary

Account Details

The Account Summary provided businesses with a real-time overview of their insurance coverage and payment status.

UX Enhancements & Features

Redesigned dashboard layout to ensure critical account details (coverage status, billing cycles, outstanding balances) were clearly visible.

Optimized data visualization, making complex coverage and payment details easier to interpret at a glance.

Improved accessibility for screen readers, ensuring that HR professionals and finance teams could efficiently navigate account details.

Impact

Reduced administrative errors by ensuring HR teams had a clear, structured view of coverage details.

Improved efficiency, allowing businesses to quickly identify coverage gaps or upcoming payments.

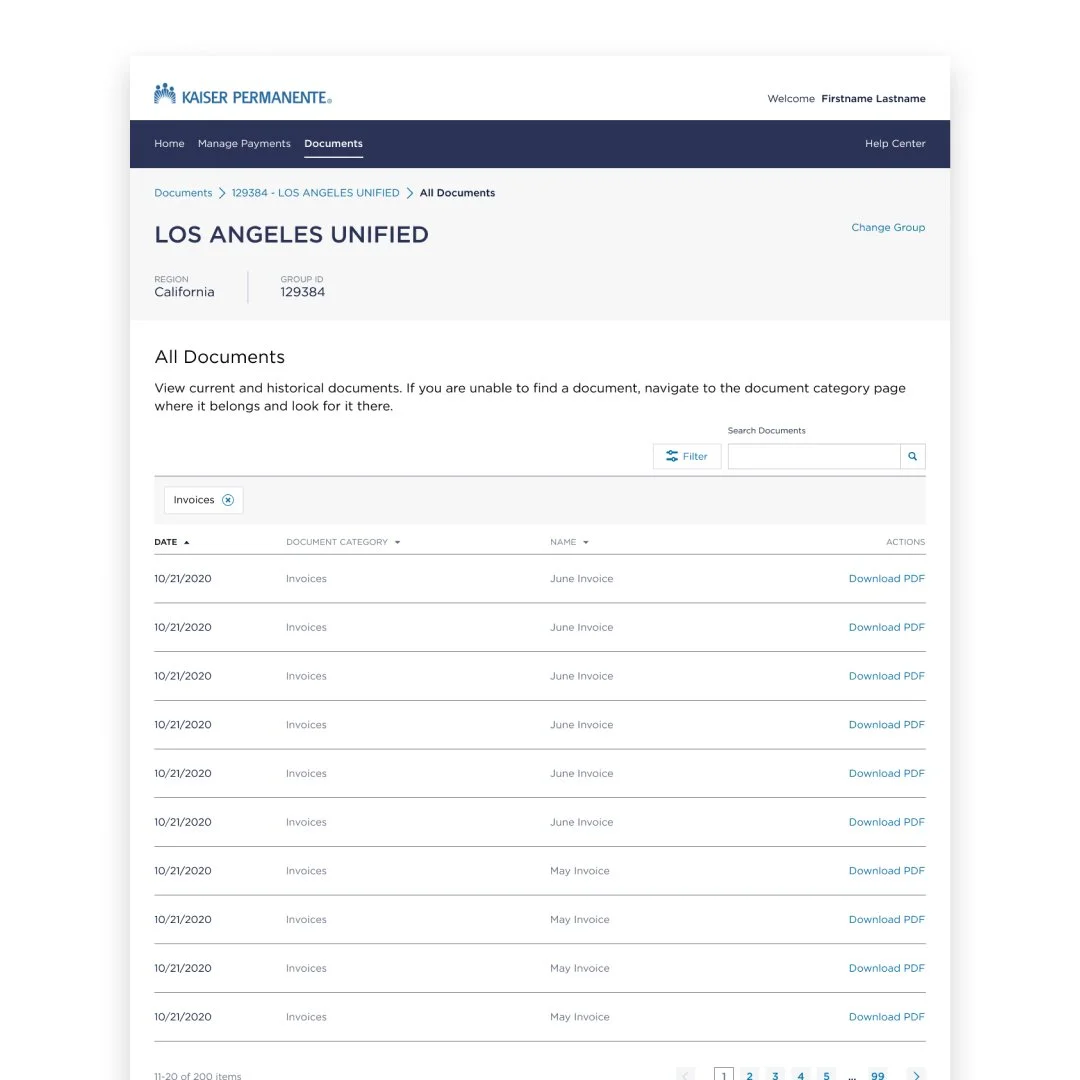

Document List – Simplifying Access to Compliance & Coverage Documents

Document List

Document Detail

Businesses needed quick access to policy documents, invoices, and compliance reports. The Document List redesign improved how HR teams retrieved and managed documents.

UX Enhancements & Features

Introduced a structured filtering and search system, enabling users to quickly find specific documents.

Improved document preview capabilities, reducing unnecessary downloads and improving workflow efficiency.

Enhanced accessibility with clear labels, keyboard navigation, and improved readability.

Impact

Increased productivity by reducing the time spent searching for documents.

Minimized errors in benefits management by making the most recent policy updates easily accessible.

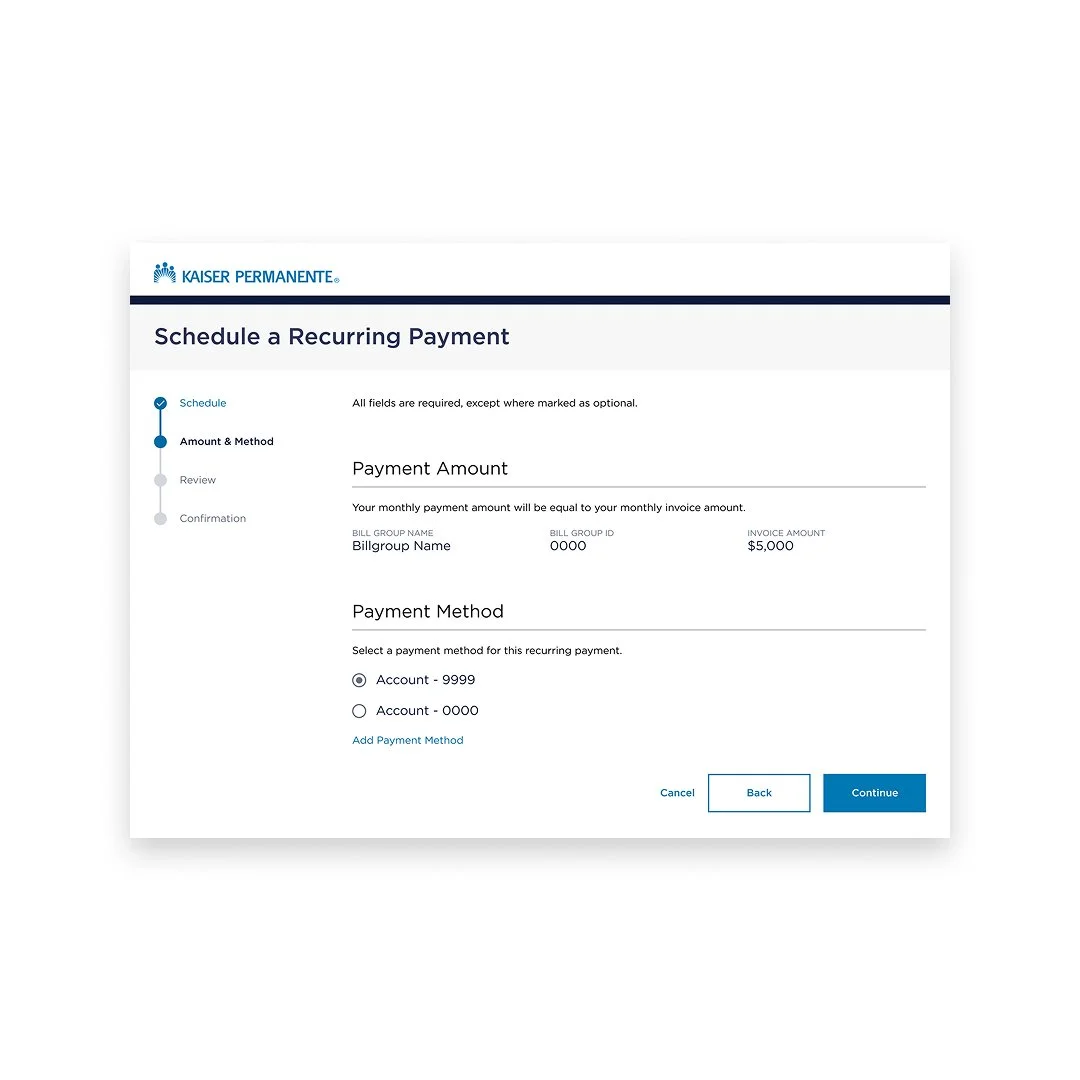

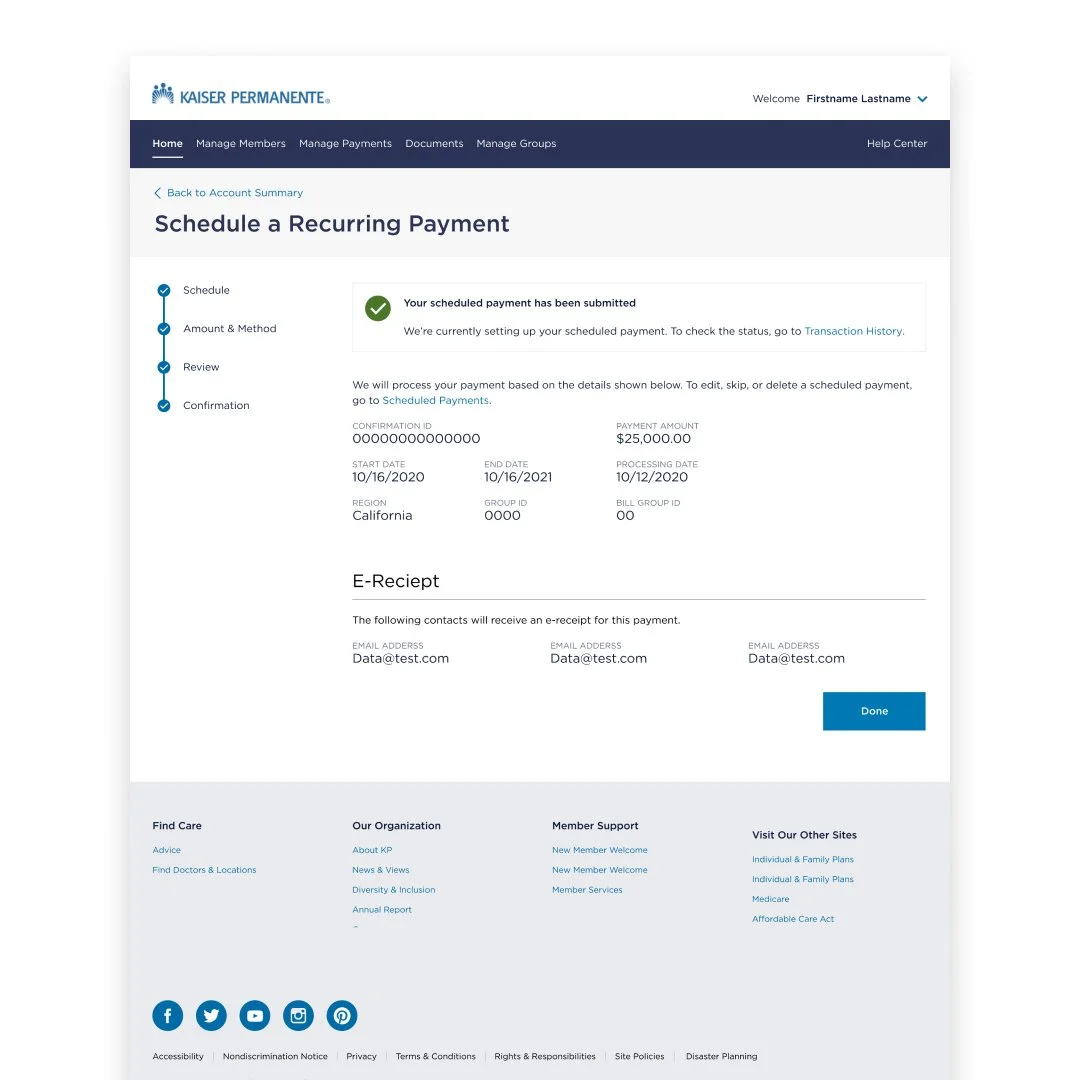

Recurring Payment Setup – Automating Billing for Businesses

Schedule Payment

Payment Amount

Review Recurring Payment

Recurring Payment Confirmation

Recurring Payment Setup – Automating Billing for Businesses

To reduce manual payment management, we introduced an improved recurring payment system that allowed businesses to set up automated billing.

UX Enhancements & Features

Redesigned payment setup flow, making it easier to configure recurring payments.

Added customization options, allowing businesses to select payment frequency, preferred payment methods, and notification settings.

Improved error handling and confirmation messaging, ensuring users had a clear understanding of their setup choices.

Impact

Increased adoption of automated payments, reducing missed payments and manual processing for HR teams.

Enhanced user confidence, minimizing support calls and billing disputes.

Making a Payment Flow – Enhancing Payment Completion Rates

The Making a Payment feature was critical for ensuring on-time premium payments, and my design improvements streamlined the experience.

UX Enhancements & Features

Simplified the payment form, reducing cognitive load and friction in the checkout process.

Added payment method flexibility, ensuring businesses could use credit cards, ACH transfers, or other preferred options.

Improved confirmation screens and error messaging, guiding users through successful transactions or troubleshooting failed payments.

Impact

Reduced payment abandonment rates, increasing the percentage of on-time payments.

Minimized billing-related customer support issues by ensuring users had a clear, intuitive payment process.

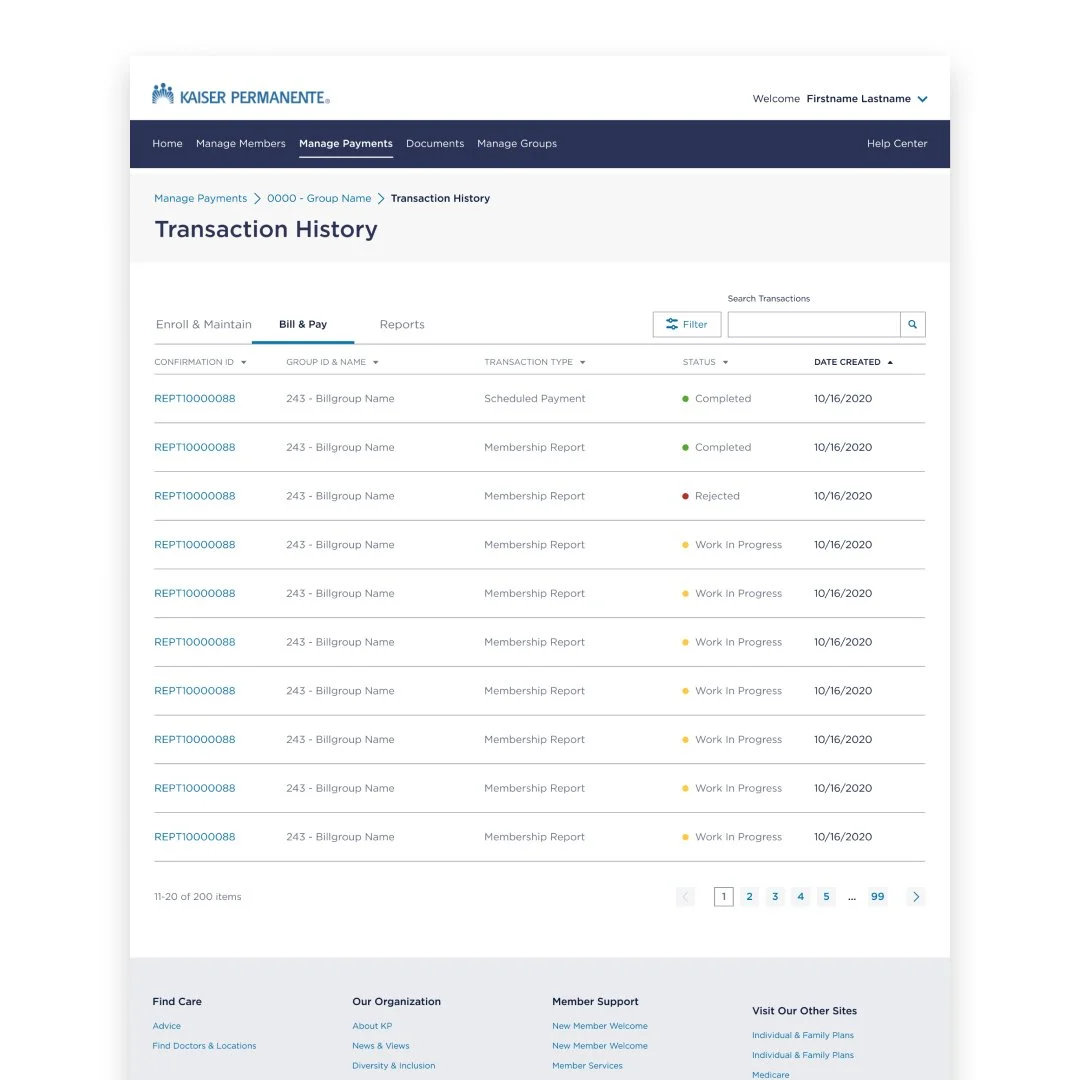

Payment History – Improving Financial Tracking for Businesses

Transaction History

Transaction Details

HR and finance teams needed a clear, structured way to track past payments, generate reports, and verify financial transactions. The Payment History feature improvements enhanced data visibility and usability.

UX Enhancements & Features

Designed an interactive, filterable payment history table, allowing users to sort by date, amount, and payment status.

Introduced export functionality, enabling businesses to generate reports for financial reconciliation.

Improved error identification, ensuring users could quickly see failed or pending transactions with clear action steps.

Impact

Increased accuracy in financial record-keeping, making it easier for HR teams to reconcile accounts.

Reduced customer support inquiries related to past payments and billing discrepancies.

Project Results

By improving account management, payment workflows, and document accessibility, I helped enhance efficiency and reduce administrative burden for businesses using KP Member Connect. These UX improvements simplified complex insurance processes, improved payment reliability, and ensured compliance with enterprise-level accessibility standards.